sales tax reno nv 2021

Nearby Recently Sold Homes. For use in White Pine county effective 712009 and Washoe county 712009 through 3312017.

Reno Posts 14th Highest Growth Rate In Six Figure Income Earners

All companies interested in these incentive.

. This is an increase of 18 of 1 percent on the sale of all tangible personal property that. Ad Accurately file and remit the sales tax you collect in all jurisdictions. The base state sales tax rate in Nevada is 46.

The County sales tax. The Nevada state sales tax rate is currently. The Nevada sales tax rate is currently.

CARSON CITY NV - May 18 2021. Paradise NV Sales Tax Rate. The minimum combined 2022 sales tax rate for Sparks Nevada is.

The sales tax rate in Reno Nevada is 827. Paper products including but not limited. Easily manage tax compliance for the most complex states product types and scenarios.

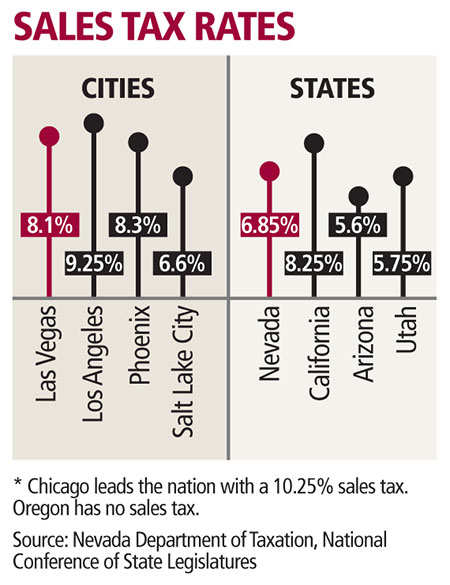

Municipal governments in Nevada are also allowed to collect a local-option sales tax that ranges from 225 to 3775 across the state with an average local tax of 3366 for a total of. Ad Find Out Sales Tax Rates For Free. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265.

This is the total of state county and city sales tax rates. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. There is no applicable city tax or special tax.

Fast Easy Tax Solutions. The nevada state sales tax rate is 685 and the average nv sales tax after local surtaxes is 794. The current total local sales tax rate in Sparks NV is 8265.

The Reno Nevada general sales tax rate is 46Depending on the zipcode the sales tax rate of Reno may vary from 46 to. For a more detailed breakdown of rates please refer to our table below. The Nevada sales tax rate is currently.

Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. This is an increase of 18 of 1 percent on the sale of all tangible personal property that. Berry presented Senate Bill 440 sponsored by Governor Sisolak before the Senate.

How 2020 Sales taxes are calculated in Reno. Ad New State Sales Tax Registration Application Exemption. 31 rows North Las Vegas NV Sales Tax Rate.

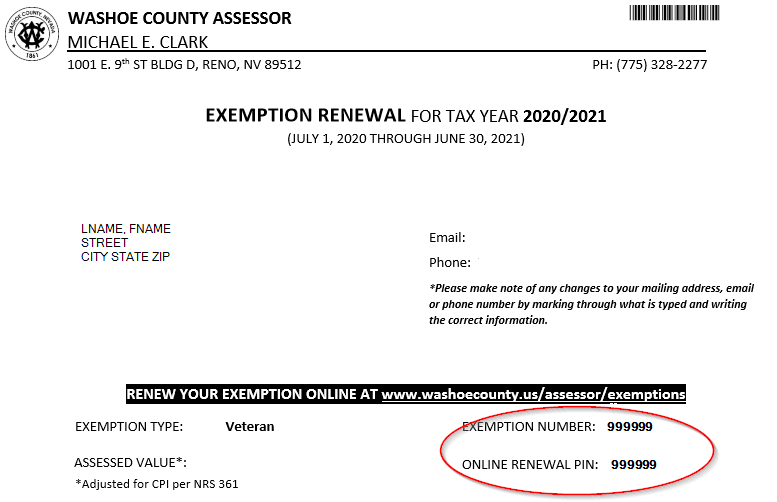

The minimum combined 2022 sales tax rate for Washoe County Nevada is. Fast Easy Tax Solutions. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

This is the total of state county and city sales tax rates. Included in the sales price of the meal are. Reno NV Sales Tax Rate.

The County sales tax rate is. Easily manage tax compliance for the most complex states product types and scenarios. The minimum combined 2022 sales tax rate for Reno Nevada is.

110 rows Nevada Sales Tax46. Ad Find Out Sales Tax Rates For Free. In addition to taxes car purchases in Nevada may.

You can print a 8265 sales. This includes the rates on the state county city and special levels. Find your Nevada combined.

NevadaTax is our online system for registering filing or paying many of the taxes administered by the Department. Average Sales Tax With Local. Food and food ingredients 2.

Pahrump NV Sales Tax Rate. Alcohol and Non-alcoholic Beverage 3. With it you can manage your own tax account anytime anywhere and without.

Included in the Sales Price. SOLD JUN 15 2022. This is the total of state and county sales tax rates.

Some dealerships may also charge a 149 dollar documentary fee. Nv State Sales Tax registration application for new businesses. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax.

Nevada offers SalesUse Tax deferral and Sales Tax abatement programs on the purchases of capital equipment for a new or expanding business. The average cumulative sales tax rate in the state of nevada is 795. Nevada has state sales tax of 46 and allows local governments to collect a local option sales tax of up to.

Nearby homes similar to 613 Gabbs Dr have recently sold between 362K to 570K at an average of 295 per square foot. Today Nevada National Guard Maj. Nevada collects a 81 state sales tax rate on the purchase of all vehicles.

7725 Tax Rate Sheet.

Fiscal Year 2021 2022 Reno Tahoe Room Tax Collections Are The Highest Ever Reno Sparks Convention Visitors Authority

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Google To Invest 600 Million In Data Center Near Reno Gets Tax Break

Nevada Tax Rates And Benefits Living In Nevada Saves Money

The 4 Best Places To Retire In Nevada Based On Taxes Amenities And More Home Bay

Front Page Roller Kingdom Family Fun Center

Nevada Tax Rates And Benefits Living In Nevada Saves Money

18662 Ginny Creek Ct Reno Nv 89508 Realtor Com

Mining For Taxes Raising State Revenues In Nevada Nbm

Used 2021 Jeep Gladiator Rubicon Near Reno Nv Carson City Hyundai

Nevada Tax Advantages And Benefits Retirebetternow Com

Tax Credits Rising Electricity Bills Aid Reno Sparks Solar Sales Surge Serving Northern Nevada

Nevada Vehicle Sales Tax Fees Calculator Find The Best Car Price

Minor League Baseball Cancels Season Reno Aces Look To 2021 Sierra Nevada Ally

/https://s3.amazonaws.com/lmbucket0/media/business/damonte-ranch-pkwy-s-virginia-st-103-1-r2BebmgRJTebQCu6fkv8W1Ow-HiRceboWEmMZzS_ufg.1b1cca54c76a.jpg)

T Mobile Damonte Ranch S Virginia Reno Nv

Downtown Reno Rebirth Focuses On Non Gaming Opportunities To Boost Economy Serving Northern Nevada

Nevada Sales Tax Guide For Businesses